What were Steam's most unexpected successes of the last 2 years?

Publikováno: 23.1.2026

Also: plenty of news, and this week's notable Steam debuts analyzed.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, and couldn’t be more relentlessly pleased to see you all, as we glide effortlessly into the weekend. This time, we’re digging up data on Steam games that did way better than their wishlists implied, and asking what we can learn from them…

Before we start, the social media intern* at the Video Game History Foundation just dug out this 2003 Electronics Boutique catalog ad which had Kirby: Air Ride and Zelda: Windwaker priced at $49.99 USD, but the GameCube hardware itself at only $99.99! Console ‘hardware to game’ price ratios? Not 2x any more. (*Fine, fine, it was me.)

[WANT A FREE DEMO OF GDCo PRO? Studios, get a demo of our GameDiscoverCo Pro company-wide ‘Steam deep dive’ & console data by contacting us today-~90 orgs have it. Or, signing up to GDCo Plus gets the rest of this newsletter and Discord access, plus more. ]

Game discovery news: Hytale getting hy coverage

Let’s start out with discovery and platform newsbites, just as the U.S. TikTok deal closes, ensuring the platform will still be around for meme-y short game videos:

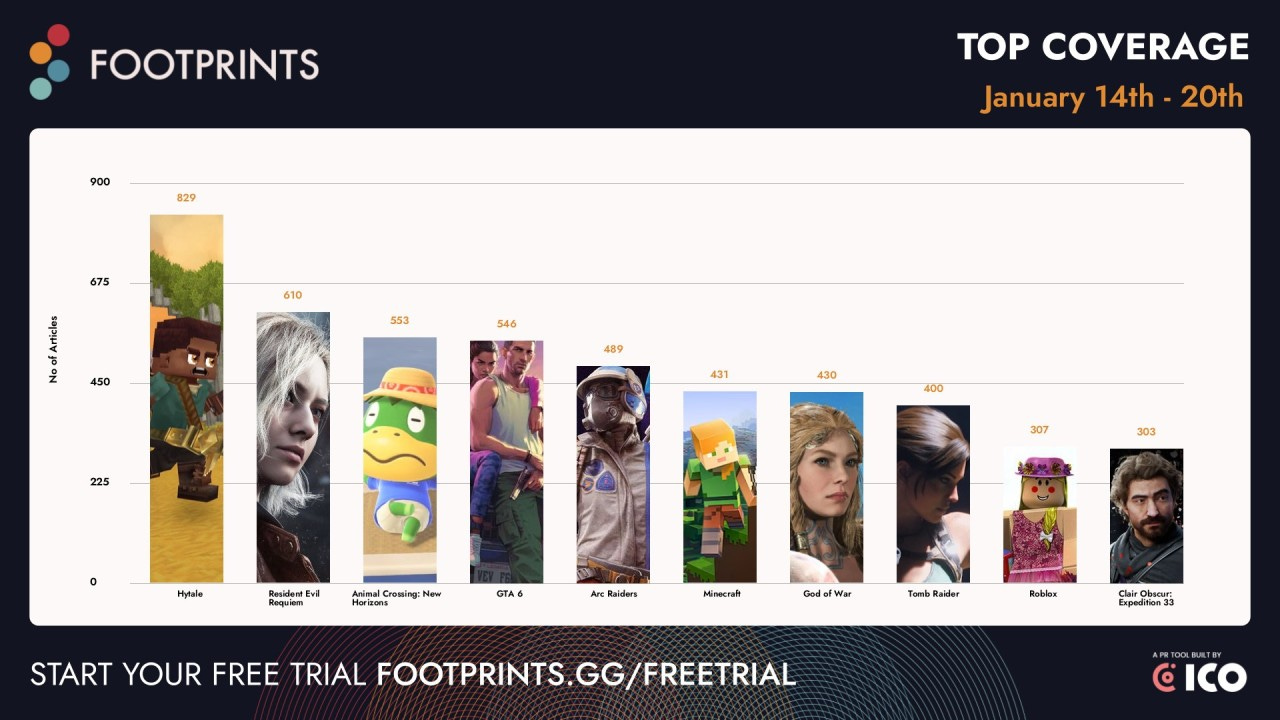

Our buddies at ‘trad PR’ monitoring tool Footprints.gg looked at the week’s top written media coverage, and Minecraft-like Hytale (on PC, not on Steam) tops the charts. Also hot: Resident Evil: Requiem, the Switch-exclusive Animal Crossing: New Horizons (due to a new patch), and GTA 6 (due to.. a boiler room explosion?)

Circana’s U.S. game hardware & select software #s for Dec. are out, and “Dec. [console] spending increased by 6% [YoY], to $1.2 billion. Unit sales in the month fell by 8%… while the average sales price increased by 18%.” Switch 2 led hardware sales, and at 4.4m units LTD, it’s “nearly double the [time-aligned] installed base” of Switch 1.

As for the entire year (per Circana), all game consoles & software (including mobile games) were up 1.4% to $60.7 billion. And for 2025’s PC/console games* (*minus select digital sales), the Top 5 were Battlefield 6, NBA 2K26, Borderlands 4, Monster Hunter Wilds, and then Call Of Duty: Black Ops 7. Interesting.

Xbox’s Developer Direct detailed first-party titles like Fable - open-world and launching later this year - and the hot Forza Horizon 6 (set in Japan, out May 16th.) Also notable: Game Freak’s Beast Of Reincarnation, and Double Fine’s surprise announce (an ex-jam game), “online multiplayer pottery-party brawler” Kiln.

Some interesting Steam front-page ‘takeover’ banner behavior: SteamDB grabs many examples. But we spotted a new one for Cult Of The Lamb’s Woolhaven DLC, and discovered (via GDCo’s Discord) that it only shows to owners or wishlisters of COTL. (That’s a nice custom placement, reserved for super-big games/DLC.)

Event microlinks: Europeans are looking skeptical on attending U.S. events this year due to gestures broadly; it appears that Reboot Develop 2026 in Croatia might not be happening (no organizer confirmation tho?); I’ll be appearing at this GDC-adjacent Games Growth Guild event about (huh) game discovery.

Some good info on the Steam Machine verification program: “According to Valve designer Lawrence Yang, developers hoping for a ‘Steam Machine Verified’ badge can expect ‘fewer constraints’ than Steam Deck... ‘One easy rule of thumb is that if your title is Verified on Steam Deck, it will be Verified on Steam Machine.’ Yang continued.”

My latest column for This Week In Videogames($) is about algorithm-picked (by ratings and review count) paid ‘top games of 2025’ charts. Steam250’s was (ignoring 1.0s): R.E.P.O., Dispatch, Clair Obscur, PEAK, Split Fiction. SteamDB’s has more niche: Dispatch, Shelldiver, Split Fiction, Öoo, Chill With You: Lo-Fi Story.

Another check-in for Netflix Games’ current strategy, via The Verge: “Netflix’s ‘cloud-first games strategy’ is one of its focuses for 2026. Netflix, in its Q4 shareholder letter, says that early results for its cloud-streamed TV games launched last year are ‘encouraging.’”

Misc Steam things: some of the Accessibility categories have changed, including a new ‘Playable At Your Own Pace’ tag; the latest Steam Client update includes library sortability by language and accessibility features; there’s now better permissions and controls for developer Web API keys.

Steam’s most unexpected successes of 2024-25?

We were recently chatting in our GDCo Plus/Pro Discord about why Only Climb: Better Together had a tiny amount of followers on its release date in 2023, and suddenly did very well*. An interesting question! And this led us to wondering if we could query our entire database for similar ‘zero to hero’ games.

(*FYI: Only Climb’s launch success was all down to streamers and the fact the Only Up! phenomenon was still pretty early. So a co-op multiplayer version immediately went viral.)

A little context, first. Steam followers or wishlists are a decent ‘raw’ indicator of interest, but should not be taken as a guarantee of success. You need community engagement, influencer pickup, and short-term momentum for that.

An example of conversion variance can be seen in October 2025’s top new Steam releases (below, with LTD copies sold & rev estimates from GameDiscoverCo Pro.) The 7-day ‘sales compared to wishlists’ metric varies by as much as 20x from the 0.11x median:

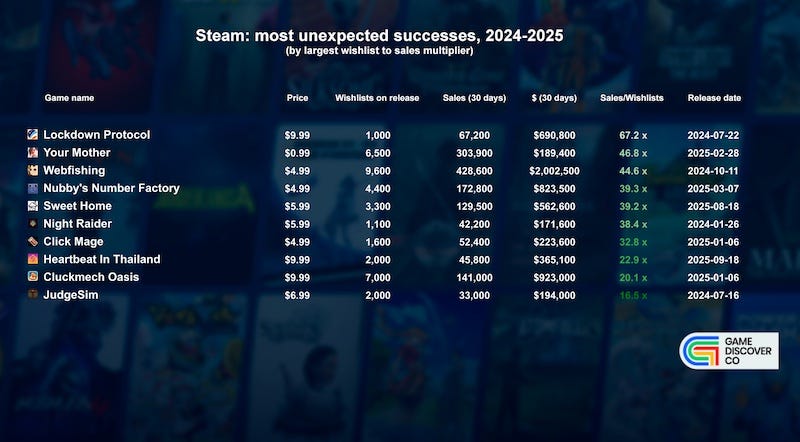

But taking the idea that ‘games with hardly any wishlists don’t suddenly sell great’, we searched our database to find titles that did. And here’s the top examples from 2024 and 2025, ranked by ‘30 day sales as a multiple of launch wishlists’:

So these are insanely high multiples, right? Even RV There Yet? in the Oct. top sellers chart maxed out at 48x median. And these are 150x to 500x median (lol!) Analysis:

The pricing on games that overperform this hard? Modest! Everything in the Top 10 ranges from $0.99 (‘computer desktop companion’ Your Mother), to $9.99 (social deduction hit Lockdown Protocol & roguelike tower defense-r Cluckmech Oasis, among others), with a sweet spot at $4.99-$7.99.

Bitesized pricing doesn’t necessarily mean bitesized playtimes: for example, famously chill hang-out fishing sim Webfishing has a median time played of 8.5 hours, we estimate. And plinko-style roguelike Nubby’s Number Factory has a median of 7 hours and an average of 12.5 hours. (It’s not ‘buy and forget’.)

Unsurprisingly, most of these titles are from tiny devs, sans marketing: a lot of the games - like pixel art clicker Click Mage - are more marketable on gameplay mechanics or fun, than visuals. But if you’re launching with <10k wishlists, you likely haven’t done much conventional marketing.

We still think these viral games are highly worth exploring, though. There’s all kinds of interesting microgenres in here that could benefit from teams iterating or creating twists on them. (Some might enable you to increase the default game sales price somewhat, if that’s necessary for your solvency - though some will not.)

And looking further at genre, here’s the Top 50 ‘unexpected’ paid titles, sorted by most-referenced select genre tags from the Top 6 on the Steam page:

We’re not surprised to see genres like ‘Roguelike’ in here. But you might be surprised to see ‘Dating Sim’ or ‘FMV’. (That’s because of games like Heartbeat In Thailand and Road To Empress, which are China-first FMV dating titles continuing the Love Is All Around trend which often blow up post-release - here’s a guide for the curious.)

We’re less surprised to see ‘Idler’ in here. Titles like desktop toy Ropuka’s Idle Island are doing well outside of the Top 10. And clickers like Click Mage, which we already mentioned, are unlikely to do well pre-release, but might pick up interest afterwards.

For good measure, here’s the top tags (all!) for the Top 100 games, if you like looking at the fine print:

So that’s our look at a slice of the market you probably haven’t seen before. We’re not suggesting the overperformance of these titles is necessarily replicable. (The point of a massive, open market is that there will be ‘needle in a haystack’ successes.) But there’s things to learn from all of them…